How Digital Video Makes More Sense than TV for Brands

Picture of Digital Video and TV Advertising. Photo: IAB

With brand marketers always looking to get the most out of their advertising budgets, the Interactive Advertising Bureau (IAB) today – Feb. 25 – released “A Comprehensive Picture of Digital Video and TV Advertising: Viewing, Budget Share Shift and Effectiveness.”

It is a Nielsen research study commissioned by the IAB investigating how moving dollars from TV ad budgets to digital media – especially digital video – affects reach and costs.

Shared at the sixth IAB Annual Leadership Meeting, “Big Data & Big Ideas: Friends, Enemies, or Frenemies?,” at the Arizona Biltmore in Phoenix, the report reveals that a 15 percent shift in media spend to digital will drive a distinct increase in advertiser reach across verticals.

[ “Agencies Need to be Intrepid Explorers” – Jack Klues, chief executive officer, VivaKi ]

Meanwhile, to discuss the critical issues in the online ad market, RMN Digtal invited Ola Tiverman, CEO, Admeta for an exclusive interview with RMN Digital managing editor, Rakesh Raman. Here’s what he says. (Read: Is Online Ad Market Gaining Maturity?)

The IAB study benchmarked how real TV schedules across key advertiser verticals perform as money moved to digital. To accomplish this, the research examined 18 real TV schedules across advertiser verticals.

Categories included Consumer Packaged Goods (CPG), specifically Health & Beauty and Food & Beverage, as well as non-CPG verticals such as Technology, Automotive, Retail, Finance and Telecom.

[ Also Read: 10 Reasons I Like Indian TV Shows ]

Findings pointed to various benefits from a 15 percent shift into digital:

- On average, CPG reach grew 3.4 percent (3.4 reach points) among persons 18 and older (P18+) when 15 percent of ad spend moved into digital

- In all other categories beyond CPG, schedules consistently averaged an incremental reach of 6.2 percent (or 6.2 reach points) at the same reallocation of 15 percent of budget to digital among P18+

- Across verticals, the 15 percent share shift results in more reach at lower costs per point, dropping from an average of $67.6K to $63.0K

- Corresponding CPMs decline from $13.82 to $12.31

[ Also Read: Dentsu Opens “Hello! Japan” TV Channel in Singapore ]

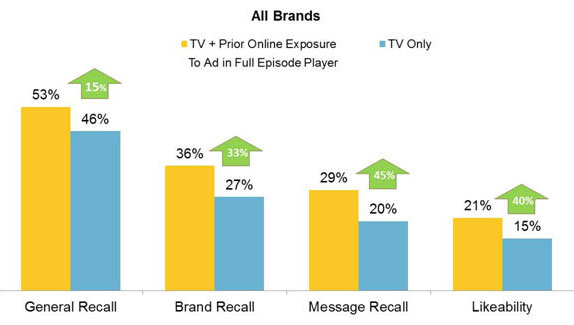

Research demonstrated that planning and running video ads online prior to TV boosts brand recall for that same ad playing on television by 33 percent. There were similar gains when it came to online display ads, with consumers 25 percent more likely to recall the brand if they had seen the display ad before seeing the ad on TV.

“This study documents that brands need both online media, especially digital video, and TV to reach consumers effectively,” said Sherrill Mane, senior VP, Research, Analytics and Measurement, IAB.

The Interactive Advertising Bureau (IAB) is comprised of more than 500 leading media and technology companies that are responsible for selling 86% of online advertising in the United States.