Digital Drives Entertainment & Media Industry Growth

Consumer access to entertainment & media (E&M) content and experiences is being democratized by ever increasing access to the Internet and explosive growth in the ownership of smart devices.

According to PwC’s annual Global Entertainment and Media Outlook 2013-2017 – a five-year outlook for global consumer spending and advertising revenues directly related to entertainment and media content – released Tuesday, even though traditional, non-digital media will continue to dominate E&M spending during the forecast period, growth will be concentrated in digital media platforms and consumption.

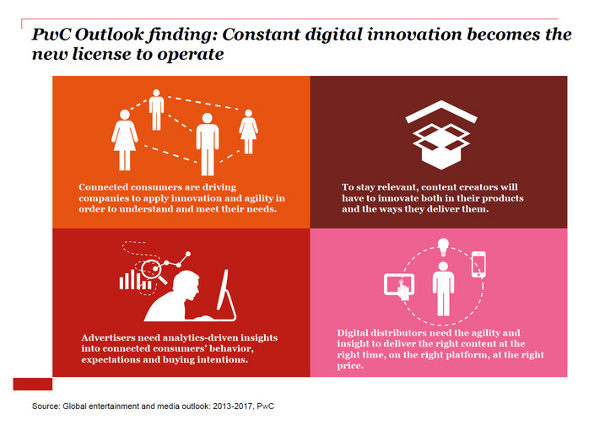

Therefore, E&M companies are raising the bar in terms of customer insight and engagement, as well as business model and operating agility, as digital innovation continues to redefine the industry landscape.

The Outlook forecasts that global E&M spending is expected to rise from $1.6 trillion in 2012 to $2.2 trillion by 2017, growing at a compound annual growth rate (CAGR) of 5.6 percent.

The U.S. remains the largest E&M market, growing at 4.8 percent CAGR reaching $632 billion in 2017, from $499 billion in 2012.

Digital E&M spending, largely driven by widespread smart device ownership, is expected to account for 44 percent of all spending in mature markets by 2017, which is almost double the level in 2008 and up from 34 percent in 2012.

Digital spending in the U.S. is expected to account for 43 percent of all E&M spending in 2017, up from 31 percent in 2012.

“The E&M industry is undergoing a significant shift as digital disruption across every segment is accelerating and as digital media remains the clear driving force behind E&M revenues over the next five years,” said Ken Sharkey, PwC’s US entertainment, media & communications practice leader.

“To drive growth and compete effectively in the future, E&M companies must invest in constant innovation that encompasses its products and services, operating and business models and, most importantly, focus on customer experience, understanding and engagement.”

Outlook findings showcase how current industry trends are impacting consumers, advertisers, content creators and digital distributors.